child tax credit 2021 dates canada

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. CCBYCS Payment Dates.

It will not be reduced.

. For the July 2021 to June 2022 payment cycle the CCB provides a. Maximum Canada child benefit. 6 to 17 years of age.

15 opt out by Oct. Canada child tax benefit Universal child care benefit GSTHST credit Canada workers benefit Provincial and territorial benefits Childrens special allowances. Your five-year-old child can get you as much as 8000 in CCB.

For more scheduled future dates of monthly. May 28 2021 includes amounts for January and April July 30 2021. Therefore your total CCB payment for 2022 is equivalent to 13666 53635 830252.

The CCB benefit period is from July 2021 to June 2022 and your CCB amount will depend on your 2020 taxable income. Here are the child tax benefit pay dates for 2022. The CRA has made huge changes to the Canada Child Benefit in 2021.

You will not receive a monthly payment if your total benefit amount for the year is less than 240. For family income levels between 24467 and 41000 you receive a partial benefit. Monday 1 August summer bank holiday Scotland only.

The 500 nonrefundable Credit for Other Dependents amount has not changed. When your adjusted family exceeds 41000 the working component for ACFB is reduced. Creating more benefits to supplement CCB.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The following amounts are for the payment period from July 2021 to June 2022 and are based on your AFNI from 2020. Under the American Rescue Plan the IRS disbursed half of the 2021 Child Tax Credit in.

As mentioned the maximum you can receive is 1200 per child for the year. These individuals may not yet be able to. For the July 2021 to June 2022 benefit period you receive the following amounts ie.

If your adjusted family net income AFNI is under 32028 you get the maximum payment for each child. Wait 5 working days from the payment date to contact us. You can play around with this Canada Child Benefit calculator to estimate your benefits in 2022.

Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairment. Apply for child and family benefits including the Canada child benefit and find benefit payment dates. Instead you will receive one lump sum payment with your July payment.

13 rows Canada Child Benefit Amount. Reduce CCB payment for 2 children by 5044 31949 536350. Depending on your income level you can expect to receive.

For January to June 2021 the total. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Working component if your income exceeds 2760. 5 July 15 2021 August 13 2021 September 15 2021 October 15 2021 November 15 2021. Based on the benefit periods 2020-2021 and 2021-22 eligible CCB recipients with at least one child below six years old could receive 6799.

Posted by Puja Tayal Published February 23 2021 400 pm EST. Benefit and credit payment dates reminders. Between July 2021 and June 2022 your child under six years old can get you up to 6833 in CCB if your average family net income falls below 32028.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the. Canada Child Benefit Young Child Supplement CCBYCS Payment Amount. Child Tax Benefit Payment Dates 2022.

CCB payments and amounts are updated every July based on your last tax return. And related federal provincial and territorial programs. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

For the period from July 2021 to June 2022. Go to My Account to see your next payment. Its usually around the 20th of the month but some dates are different for example December its a little earlier because of the holidays.

If your 2020 AFNI is 32028 or below you can get the maximum benefit of 6833. It also provides the 3000 credit for 17-year-olds. November 25 2022 Havent received your payment.

By August 2 for the August. Related services and information. 13 opt out by Aug.

Under 6 years of age. Alberta child and family benefit ACFB All payment dates. The couple would then receive the 3300 balance 1800 300 X 6 for the younger.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. 3000 for children ages 6 through 17 at the end of 2021. Wait 10 working days from the payment date to contact us.

9 Possible Reasons You Didnt Get Your First Child Tax Credit Payment. 15 opt out by Aug. Monday 29 August summer bank holiday.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 3600 for children ages 5 and under at the end of 2021. Here is the full list of bank holidays for 2021 and early 2022.

Canada workers benefit CWB - advance payments All payment dates.

Tax Form Preparation Including T4s T4as And T5s In Canada Tax Recovery In 2021 Tax Services Filing Taxes Tax Forms

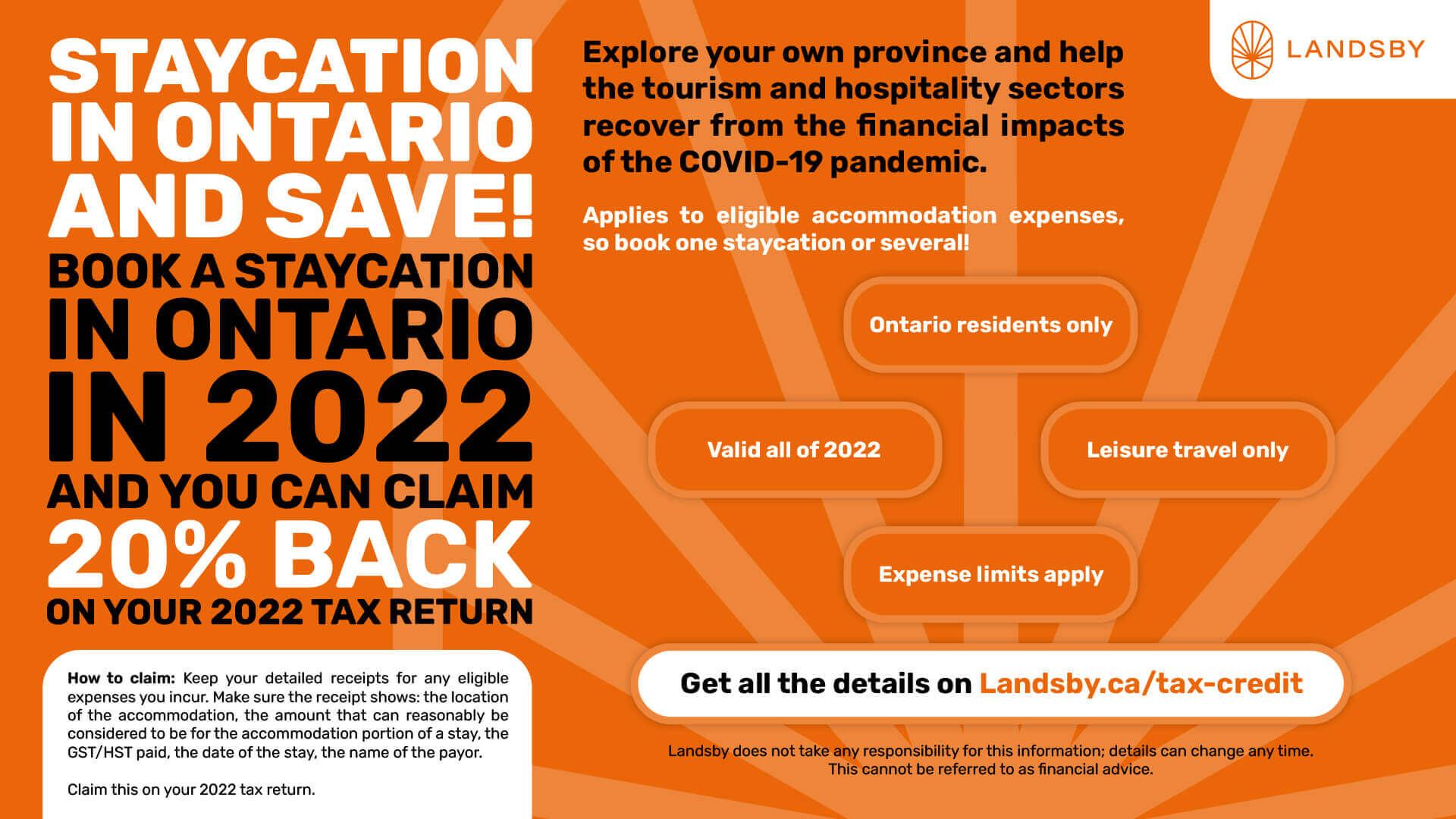

2022 Ontario Staycation Tax Credit Guide Landsby

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

How Can You Qualify For Disability Tax Credits For Adhd Parental Guide

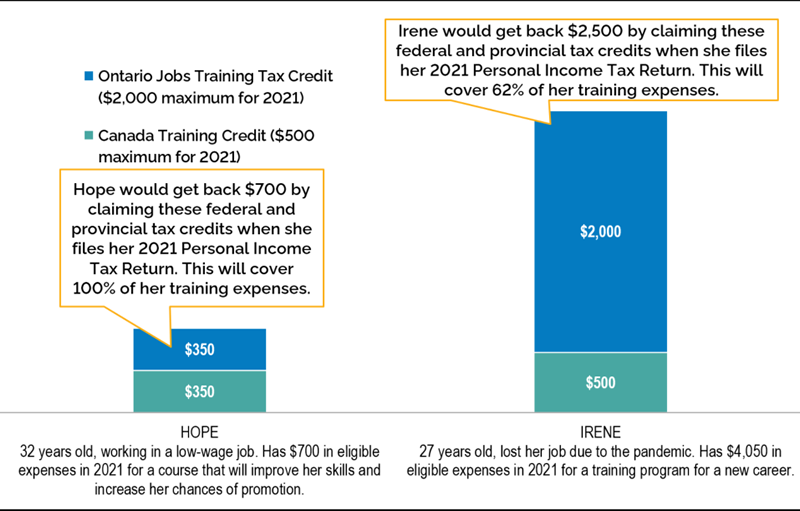

Ontario Jobs Training Tax Credit Ontario Ca

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Pin On Income Tax Calculators Net Income Calculators

Money Dates 2019 Ativa Interactive Corp Dating Personals Dating How To Plan

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

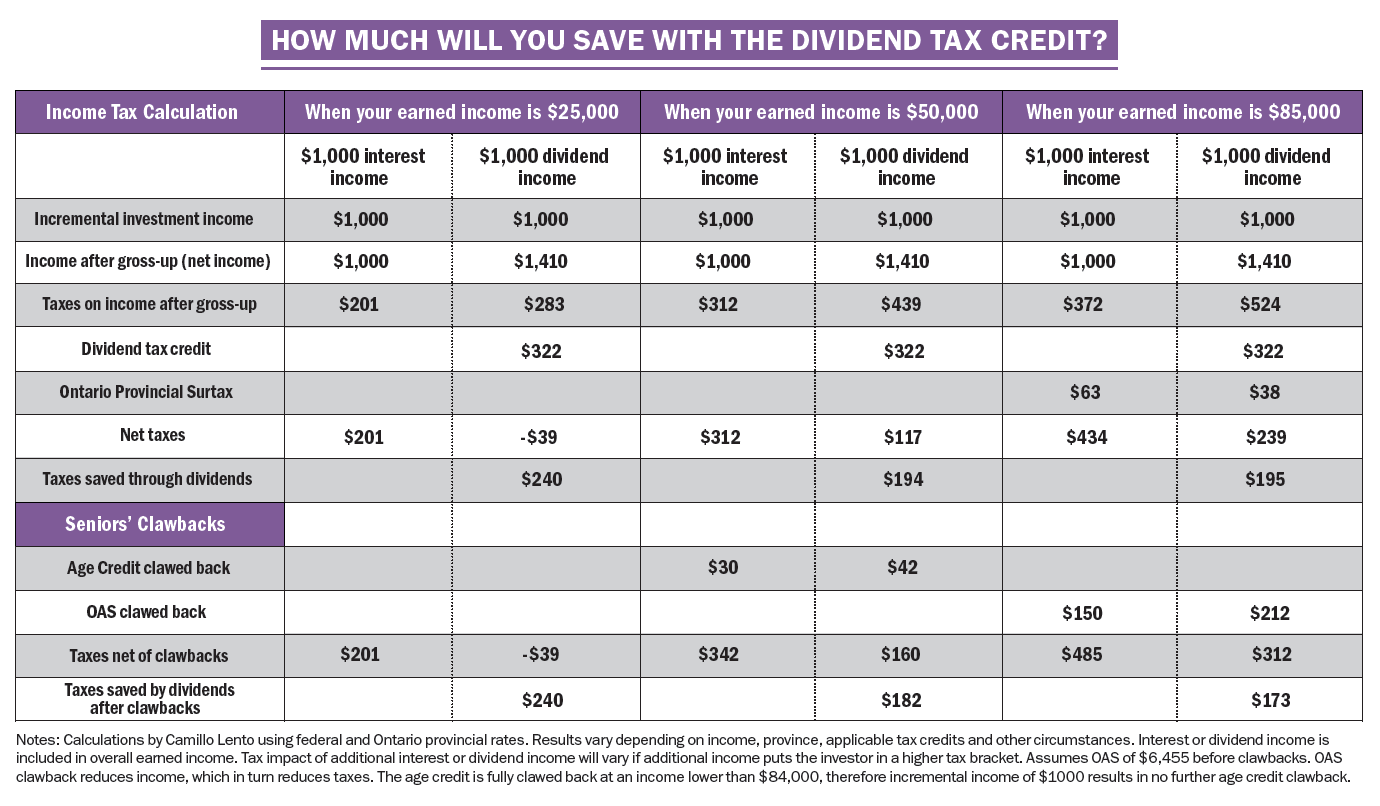

How The Dividend Tax Credit Works

Canada S Tuition Tax Credit How It Works Nerdwallet Canada

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Rrsp Tfsa Oas Cpp Ccb Tax And Benefit Numbers For 2021 Tax Numbers Tax Return